Does the thought of writing a check fill you with trepidation? You’re not alone. Checks remain a ubiquitous form of payment, yet many people struggle with the simple task of filling one out correctly. Whether you’re a young adult venturing into the world of finance or an experienced professional looking to refresh your skills, this comprehensive guide will provide you with the knowledge and confidence to master the art of check writing.

By the end of this article, you’ll be able to avoid costly mistakes and ensure your checks are processed smoothly and without any hassles.

How to Write a Check

Materials You’ll Need

Before you start, gather the necessary materials: a checkbook, a pen, and the recipient’s name and address. Ensure your checkbook is current and has blank checks available.

Choose a pen with dark, permanent ink that won’t smudge or fade over time. This will help prevent alterations and ensure the check’s validity.

Double-check the recipient’s name and address to avoid any errors. Writing the wrong information can delay or even prevent the check from reaching its intended recipient.

Filling Out the Check

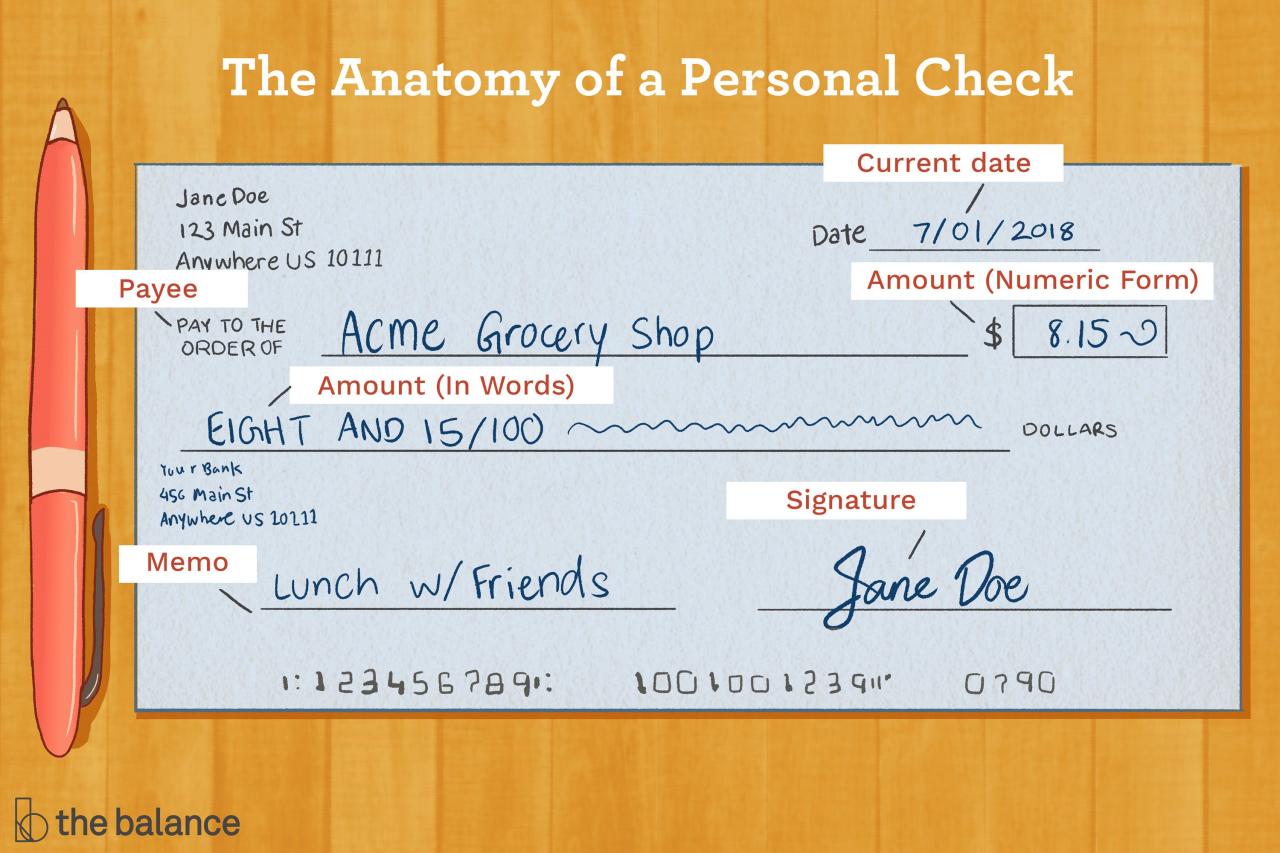

The front of the check has several sections you need to fill out. Start with the date line in the top right corner. Write today’s date to indicate when the check was issued.

In the “Pay to the Order of” line, write the recipient’s full name exactly as it appears on their financial accounts. This ensures the funds are deposited into the correct account.

In the “Amount” box, write the amount of the check in numerals. For example, if you’re writing a check for $500, write “500.00.”

Writing the Dollar Amount in Words

On the line below the “Amount” box, write the amount of the check in words. This serves as a safety measure to prevent fraud or alterations.

Start by writing the dollar amount in numerals, followed by the word “and” and the cents amount. For example, for a check of $500, write “Five hundred and 00/100.”

Avoid leaving any blank spaces or using abbreviations. The dollar amount should be written clearly and precisely.

Signing the Check

In the bottom right corner of the check, you’ll find the signature line. Sign your name exactly as it appears on your bank account. This authorizes the bank to deduct the funds from your account and transfer them to the recipient.

Ensure your signature is legible and consistent to avoid any issues during processing.

Once you’ve signed the check, it becomes a legally binding document. Handle it with care and keep it in a safe place until it’s delivered to the recipient.

Verifying Check Information

Before mailing or handing over the check, it’s crucial to verify the information you’ve filled out to ensure accuracy. Double-check the following:

Name and Address: Confirm that the recipient’s name and address are correct and match their financial records.

Date: Ensure the date you’ve written is current and accurately reflects the date the check was issued.

Numeral Amount: Verify that the amount you’ve written in numerals in the “Amount” box matches the amount you’ve written in words.

Written Amount: Carefully review the written amount to ensure there are no errors or omissions. It should correspond exactly to the numeral amount.

Check Alterations and Safety

Checks are often used as a convenient form of payment, but they can also be subject to fraud or alterations. To protect yourself and your funds, consider the following safety measures:

Secure Storage: Keep your checks in a secure location, away from unauthorized access.

Voiding Old Checks: If a check is lost or stolen, immediately report it to your bank and void the check number. Make sure to keep a record of the voided check.

Use Security Features: Some checkbooks come with built-in security features, such as watermarks, microprinting, or holographic images. These features can help deter counterfeiting and alterations.

Handling and Delivery Options

Once you’ve written and verified the check, it’s important to handle it properly and choose the best delivery method:

Mail: If mailing the check, use a secure envelope to prevent tampering or theft. Consider using registered mail for added security.

Hand Delivery: If delivering the check in person, meet the recipient in a secure location and obtain a receipt or confirmation of delivery.

Electronic Payment: For convenience and efficiency, consider using electronic payment methods such as online banking or mobile payment apps. These options can be more secure and offer instant confirmation of delivery.